First Impressions of Manifold

As most of my readers probably know, I have been trying out Manifold for the past couple of weeks. I will compare it to Metaculus, since that is my other forecasting poison of choice.

In brief: Manifold was very fun initially, but then it became a little repetitive. It does have some merit, though, so I will trade in markets a little longer. Details below!

On forceasting platforms, we enter probabilities

Before we dive into Manifold, I can’t not compare it to Metaculus, because that’s the other forecasting platform where I’m active.

Metaculus (not Manifold) is a forecasting platform and community. When we use Metaculus, we look at a question, and enter what we think is the probability that it will turn out to be true. When the question resolves, we either earn or lose points depending on how accurate our prediction was.

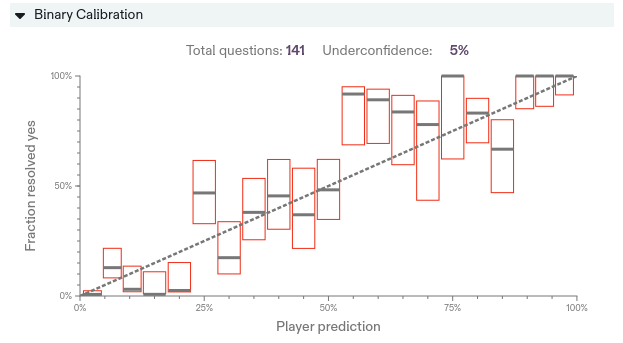

If you are any good, and you keep doing this, your calibration diagram will look better than mine, and you can brag about your forecasting skills.

What I really like about Metaculus are the tournaments. In these we are judged solely against other participants in the tournament, with a leaderboard and everything. Since questions are reviewed by moderators and resolved by administrators, questions and resolutions are always held to a high quality standard.1 This also allows Metaculus to collaborate with others and offer cash prizes both for accuracy and informative comments.

But that’s basically it: enter probability judgment, update it occasionally, then wait for question to resolve.

In prediction markets, we buy shares

Prediction markets are both simpler and more complicated at once.

Instead of entering a percentage as our forecast, we buy shares in either the yes or no direction. So if the question is currently trading at 63 %, we don’t have to indicate that we’re 79 % confident it will resolve positively – instead, we buy shares in the yes direction, which indicates that our confidence is higher than the current 63 %, but we don’t have to commit to a specific number. This makes prediction markets a little easier to be successful in.

Prediction markets require more active maintenance

But in contrast to a forecasting platform, it doesn’t end there. One of the strong points of prediction markets is that we don’t have to wait until the question resolves to profit from it. If the community judgement moves in our favour, our shares become worth more, and so we can sell them and lock in the profit.2 Or take advantage of noise between markets and rebalance the portfolio. I.e. if one market has gone up and another gone down with no real new information added, we can sell the one that has gone up and buy the one that has gone down, which means we use the profits from one to buy into the other when it is cheaper. This faster reward cycle is more fun, but also a little exhausting to stay on top of.

Another benefit of the prediction market approach is that by making canceling bets in similar markets, it’s possible to bet on very specific things, i.e. hedge out most of what the main markets are about, and retain exposure only to a small eventuality that seems underpriced. I haven’t bothered doing this much in practise, though, so I doubt it’s that meaningful unless the market runs on a huge scale.

As the above hints at, financial maneuvering and risk management becomes a prominent part of using a prediction market. We can’t just forecast. We should diversify our allocations, arbitrage between markets, rebalance our portfolio, and so on. Even something silly like selling shares to get resources to buy an underpriced market I just found takes up a surprisingly large number of my transactions.3 Why don’t I carry the liquidity in my wallet? I suspect optimal growth takes investing all money, as long as sufficient diversification is possible.

Related to financial maneuvering, in a prediction market, our ability to profit from predictions depends strongly on our disposable resources. Building the solid wealth that is needed to profit from small mispricings takes very active management as one starts out.4 Idea: there are several very short-fuse questions that resolve based on financial markets. These consistently lag behind the underlying, so I believe it should be possible to use algorithmic trading on these to build up wealth slowly but consistently. The drawback is that participation rates in these markets are low, so it’s difficult to scale that approach very far. Specifically at Manifold, the resources used to buy into questions is a type of play money that one gets from joining the platform and then most of it one earns from successful predictions.

Anyone can create and resolve questions on Manifold – and authors are rated by other users on how well they resolve questions, which does help with keeping them honest. One of the benefits of this is that it allows for more loosely defined questions, where the resolution criteria are not razor sharp.5 The forecaster, of course, compensates for this by erring more toward the side of 50 %. This makes it possible to bet on a wider variety of things than that which is strictly and objectively quantifiable. However, this also makes it harder to find interesting, well-defined high-volume questions with relatively short resolution times.6 And forecasting on these questions is necessary to progress in the league system Manifold uses.

Summary

To summarise again: there’s a lot more action going on in a prediction market like Manifold. But I also feel like a large portion of the action is motion without a purpose, and once the novelty wore off, it wasn’t that attractive to me.

So for me, personally, a forecasting platform like Metaculus is where it’s mainly at. No-nonsense forecasting, still grounded in reality.

For society at large, I think prediction markets might be an easier sell, so I will enthusiastically argue in favour of prediction markets anywhere people are willing to listen. Despite all the financial maneuvering, they are still a strict improvement over … whatever it is most adults are doing right now in terms of forecasting.